If you’re earning a paycheck in New Jersey, you might be wondering: How much of your salary actually ends up in your bank account after taxes? The short answer is — it depends on your income, filing status, deductions, and pay frequency.

This guide breaks down the exact types of taxes that come out of your paycheck in New Jersey in 2025, what percentages you can expect, and how to estimate your take-home pay more accurately.

What Taxes Are Deducted From a Paycheck in New Jersey?

Every paycheck includes multiple deductions. In New Jersey, here’s what typically comes out:

| Type of Tax | Who Takes It? | What It Covers |

|---|---|---|

| Federal Income Tax | IRS | Your federal tax obligation |

| FICA Taxes | IRS (Social Security + Medicare) | Retirement & healthcare programs |

| New Jersey Income Tax | State of New Jersey | State-level public services |

| State Disability (SDI) | New Jersey | Temporary disability benefits |

| Family Leave (FLI) | New Jersey | Paid family leave insurance |

| Local Taxes | Varies (e.g. Newark) | Only in certain areas |

Depending on your benefit elections, you might also see deductions for:

- 401(k) or 403(b) contributions

- Health insurance premiums

- HSA or FSA contributions

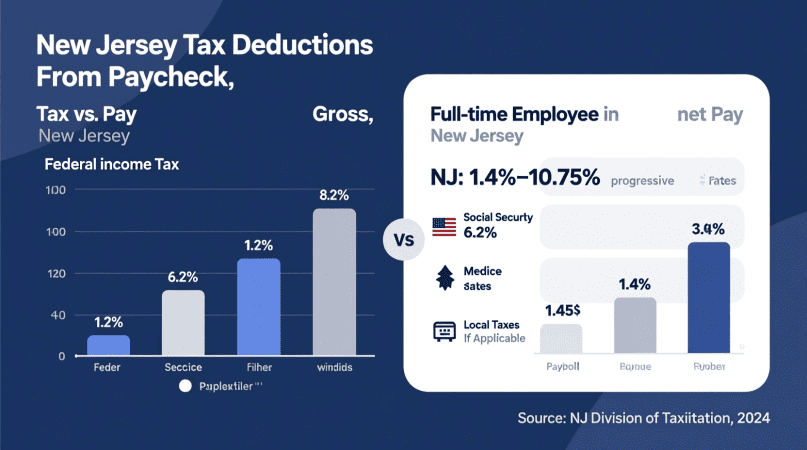

How Much Tax Is Typically Taken?

Rule of Thumb: For most New Jersey residents, 20% to 35% of gross income is withheld for taxes and mandatory programs.

Here’s a breakdown by income and pay frequency:

| Annual Salary | Pay Frequency | Estimated Tax Rate | Take-Home Pay Per Check |

|---|---|---|---|

| $40,000 | Biweekly | ~22% | ~$1,230 |

| $75,000 | Monthly | ~27% | ~$4,560 |

| $120,000 | Biweekly | ~32% | ~$3,080 |

These are rough estimates assuming standard deductions and no dependents. To calculate more precisely, try our gross-to-net paycheck calculator.

New Jersey Income Tax Brackets (2025)

New Jersey uses a progressive state income tax system. Here’s what that looks like for single filers:

| Taxable Income | Rate |

|---|---|

| Up to $20,000 | 1.4% |

| $20,001 – $35,000 | 1.75% |

| $35,001 – $40,000 | 3.5% |

| $40,001 – $75,000 | 5.525% |

| $75,001 – $500,000 | 6.37% |

| $500,001 – $5,000,000 | 8.97% |

| Over $5,000,000 | 10.75% |

If you’re married filing jointly, these thresholds are slightly higher. Unlike some other states, New Jersey does not allow local municipalities to charge income tax, with a few exceptions like Newark. Try our New Jersey paycheck calculator for a full breakdown — with options for hourly, salary, weekly, monthly, and bonus pay.

What Affects How Much Is Taken From Your Paycheck?

Several factors can increase or decrease your tax withholding:

1. Filing Status

Single, married, or head of household — this determines your federal and state tax brackets.

2. Pay Frequency

If you’re paid weekly, you’ll see smaller deductions more frequently. If monthly, the deductions may look larger per paycheck.

Explore more with our weekly paycheck calculator or biweekly paycheck calculator.

3. Benefits and Deductions

Contributions to pre-tax accounts like:

- Retirement plans (401k, 403b)

- Health Savings Accounts (HSA)

- Flexible Spending Accounts (FSA)

These reduce your taxable income and lower your tax burden per paycheck.

4. Bonuses and Overtime

Supplemental wages like bonuses are often taxed at a flat 22% federal rate. This can make your bonus check feel much smaller than expected.

Example: $60,000 Salary, Biweekly in New Jersey

Here’s a rough estimate of paycheck breakdown in NJ:

- Gross Pay: $2,308 (biweekly)

- Federal Tax: ~$230

- FICA (SS + Medicare): ~$176

- NJ State Tax: ~$90

- SDI/FLI: ~$20

- Take-Home Pay: ~$1,790

These numbers will vary based on deductions, benefits, and updated tax rates.

Common Questions (FAQs)

How much state tax is withheld in NJ?

Most residents will see 5% to 7% of their paycheck withheld for NJ state tax, depending on income level.

Do I pay local taxes in NJ?

Not usually. New Jersey doesn’t impose local income taxes statewide. Newark is an exception, where non-resident workers may pay a small local wage tax.

How can I reduce my paycheck tax in NJ?

- Contribute more to your 401(k) or HSA

- Adjust your W-4 and NJ-W4 forms

- Ensure your filing status and dependents are updated

- Take advantage of pre-tax benefits

What about contractors or freelancers?

If you’re a 1099 contractor, no tax is withheld automatically. You’ll need to pay quarterly estimated taxes to both the IRS and the NJ Division of Taxation. Consider using a contractor paycheck calculator.

- “Use our New Jersey Payroll Tax Calculator to estimate how much tax is deducted from your paycheck.”

- “Check the current New Jersey State Income Tax Rates to see how much you’ll owe based on your income.”

- “Understand What Deductions Come Out of a New Jersey Paycheck including health insurance and retirement contributions.”

- “Learn how NJ-W4 Withholding Affects Your Paycheck and how to update your form for accurate deductions.”

- “Explore our Gross-to-Net Paycheck Calculator to find your real take-home pay.”

- “Find out What Payroll Taxes New Jersey Employers Pay and how they impact your overall paycheck.”

Final Thoughts

It’s not enough to know your salary — you need to understand what hits your bank account.

If you’re planning a budget, changing jobs, or just curious, it’s worth using a paycheck calculator tailored for New Jersey.

Juanita is the creator behind njpaycheckcalculator.org, dedicated to providing accurate and easy-to-use paycheck calculation tools for New Jersey residents. With a strong focus on clarity and reliability, she helps users understand their paychecks and tax deductions with confidence. Juanita is passionate about simplifying complex financial calculations, empowering users to make informed decisions about their income and budgeting.