If you live or work in New Jersey, your salary after taxes—often called take-home pay—will be less than your gross income once federal, state, and payroll deductions are applied.

Understanding how much you actually keep helps you budget, compare job offers, and make smarter financial decisions.

Let’s break down what affects your paycheck in 2025 and how to calculate your true after-tax salary in New Jersey.

What Does “Salary After Taxes” Mean?

Your gross salary is your full income before taxes or deductions.

Your net salary, or take-home pay, is what you actually receive after all withholdings.

In New Jersey, several taxes and contributions come out of each paycheck:

- Federal income tax

- Social Security (6.2%) and Medicare (1.45%)

- New Jersey state income tax

- State payroll deductions (Unemployment Insurance, Disability, Family Leave, Workforce Development)

- Optional benefits like 401(k) or health insurance contributions

Each deduction slightly reduces your take-home pay, but understanding the rates makes it easier to estimate your true earnings.

If you want to see this breakdown instantly, try the New Jersey Paycheck Calculator.

New Jersey State Income Tax Rates for 2025

New Jersey uses a progressive income tax system, meaning higher earners pay higher rates.

Here are the 2025 state income tax brackets for single filers:

| Income Range | Tax Rate |

|---|---|

| Up to $20,000 | 1.4% |

| $20,001 – $35,000 | 1.75% |

| $35,001 – $40,000 | 3.5% |

| $40,001 – $75,000 | 5.525% |

| $75,001 – $500,000 | 6.37% |

| $500,001 – $1,000,000 | 8.97% |

| Over $1,000,000 | 10.75% |

Married filers typically have double the income range for each bracket.

These rates are applied to your taxable income, not your total salary.

To check exactly which bracket your income falls into, visit the New Jersey Income Tax Bracket Calculator.

Payroll Deductions That Reduce Take-Home Pay

Aside from state and federal taxes, New Jersey workers contribute to several state-run programs.

These deductions are small but mandatory.

| Deduction | Typical Rate (2025) | Purpose |

|---|---|---|

| Unemployment Insurance (UI) | 0.3825% | Helps workers who lose jobs |

| Disability Insurance (DI) | 0.47% | Covers temporary disability or illness |

| Family Leave Insurance (FLI) | 0.09% | Paid leave for family care or bonding |

| Workforce Development Fund | 0.0425% | Supports training and job programs |

Together, these total around 1% of your paycheck, depending on income.

They’re automatically withheld by your employer.

To understand how these deductions add up, you can check your estimated paycheck deductions using this New Jersey Deductions Calculator.

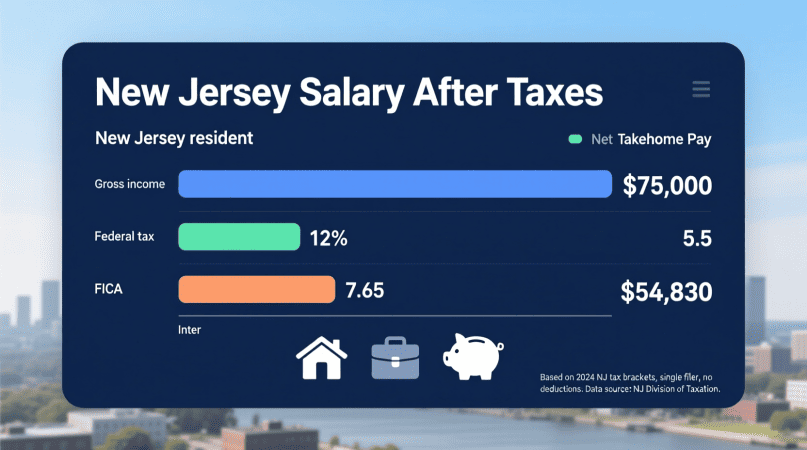

Example: Salary After Taxes in New Jersey (2025)

Let’s look at what different salaries might look like after all taxes are taken out.

These estimates include federal, FICA, and New Jersey state taxes for a single filer with no dependents.

| Gross Annual Salary | Estimated Take-Home Pay | Effective Total Tax Rate |

|---|---|---|

| $50,000 | ~$39,600 | ~21% |

| $75,000 | ~$56,700 | ~24% |

| $100,000 | ~$73,000 | ~27% |

| $150,000 | ~$104,000 | ~31% |

These numbers may vary based on benefits, pre-tax deductions, and filing status.

If you want exact figures for your situation, use the Gross-to-Net Calculator to see personalized results.

How Filing Status and Dependents Change Your After-Tax Salary

Your filing status (single, married, head of household) and number of dependents have a big impact on your final paycheck.

- Married couples generally pay less tax because they combine income and claim more deductions.

- Dependents reduce your taxable income and can increase your take-home pay.

- Head of household status provides higher deduction limits than filing as single.

If you recently had a change in family or filing status, update your NJ-W4 with your employer to adjust withholdings and avoid owing taxes at year-end

Comparing New Jersey After-Tax Salary to Nearby States

New Jersey’s top tax rate (10.75%) is higher than many neighboring states, but unlike New York City, there are no local city income taxes.

Here’s a quick comparison of how your take-home pay might differ in the region:

| State | Top Tax Rate (2025) | Local Tax | Avg. Effective Take-Home (on $100K) |

|---|---|---|---|

| New Jersey | 10.75% | None | ~$73,000 |

| New York (NYC) | 10.9% | 3.9% city tax | ~$68,000 |

| Pennsylvania | 3.07% | None | ~$77,000 |

While NJ’s rates are on the higher side, its lack of local tax keeps it competitive for take-home pay compared to New York City.

How to Maximize Your Take-Home Pay

You can’t avoid taxes, but you can manage your paycheck strategically:

- Increase pre-tax contributions like 401(k) or HSA to lower taxable income.

- Adjust your W-4 and NJ-W4 if you consistently owe or get a large refund.

- Review your benefits—using employer insurance or retirement programs saves on taxable income.

- Use accurate paycheck calculators to plan your take-home pay and budget.

FAQs About Salary After Taxes in New Jersey

1. How much of my salary will I keep after taxes in New Jersey?

Most people keep about 70–80% of their gross salary after taxes and deductions.

2. Does New Jersey have local city income taxes?

No, New Jersey does not charge city or county income taxes—only state and federal.

3. Are bonuses taxed differently in New Jersey?

Bonuses are taxed the same as regular wages for state income tax but face a 22% flat federal withholding.

4. What affects my take-home pay the most?

Federal income tax, state income tax, FICA, and pre-tax deductions such as retirement and insurance.

5. How can I calculate my exact after-tax pay?

Use an online New Jersey paycheck calculator to estimate your take-home based on your salary, dependents, and pay frequency.

Final Thoughts

Your New Jersey salary after taxes depends on your income, benefits, and deductions, but a good rule of thumb is that you’ll take home around 70 cents of every dollar you earn.

- “Use our New Jersey Salary After Taxes Calculator to find your true take-home pay.”

- “Try the New Jersey Gross-to-Net Paycheck Calculator to understand your deductions clearly.”

- “Estimate your New Jersey Payroll Taxes with our detailed calculator.”

- “Learn more about New Jersey Income Tax Brackets and how they affect your salary.”

- “See how NJ-W4 Selections Impact Your Withholding.”

- “Understand What Deductions Come Out of a New Jersey Paycheck to calculate your net earnings accurately.”

Juanita is the creator behind njpaycheckcalculator.org, dedicated to providing accurate and easy-to-use paycheck calculation tools for New Jersey residents. With a strong focus on clarity and reliability, she helps users understand their paychecks and tax deductions with confidence. Juanita is passionate about simplifying complex financial calculations, empowering users to make informed decisions about their income and budgeting.