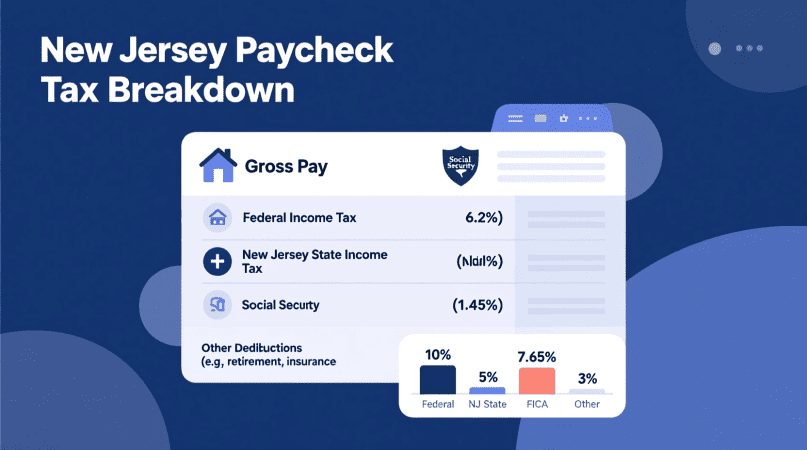

If you’ve ever looked at your paycheck and wondered, “Where did my money go?” — you’re not alone.

In New Jersey, every paycheck includes several mandatory taxes and deductions that go toward federal, state, and insurance programs. Understanding each one helps you see exactly how your take-home pay is calculated and how to plan your finances better.

Federal Taxes Withheld from a New Jersey Paycheck

Even though you live or work in New Jersey, federal taxes apply nationwide. These include:

1. Federal Income Tax

This is the biggest deduction on most paychecks. It’s calculated based on:

- Your filing status (single, married, head of household)

- The income range you fall into

- The details on your Form W-4

In 2025, federal tax rates range from 10% to 37%, depending on your income. Your employer automatically withholds the estimated amount and sends it to the IRS.

You can estimate your withholding using the federal tax calculator.

2. FICA Taxes: Social Security and Medicare

The Federal Insurance Contributions Act (FICA) ensures you’re paying into Social Security and Medicare.

- 6.2% goes to Social Security

- 1.45% goes to Medicare

If you earn more than $200,000 (single) or $250,000 (married), an extra 0.9% Medicare surtax applies.

Use the FICA calculator to see your contribution breakdown.

New Jersey State Taxes

New Jersey has a progressive income-tax system, meaning higher earners pay a higher rate.

Here’s how the 2025 brackets look for single filers:

| Income Range | Tax Rate |

|---|---|

| Up to $20,000 | 1.4% |

| $20,001 – $35,000 | 1.75% |

| $35,001 – $40,000 | 3.5% |

| $40,001 – $75,000 | 5.525% |

| $75,001 – $500,000 | 6.37% |

| $500,001 – $1 million | 8.97% |

| Over $1 million | 10.75% |

Find your bracket using the NJ income-tax bracket calculator.

State Payroll Deductions Unique to New Jersey

In addition to income tax, New Jersey requires several smaller withholdings that fund social programs:

| Deduction | Typical Rate (2025) | What It Funds |

|---|---|---|

| Unemployment Insurance (UI) | ≈ 0.3825% | Supports workers who lose jobs |

| Temporary Disability Insurance (DI) | ≈ 0.47% | Covers illness or injury off the job |

| Family Leave Insurance (FLI) | ≈ 0.09% | Paid leave for family care or new child |

| Workforce Development Fund | ≈ 0.0425% | Funds job training programs |

These deductions are small but important — they’re unique to New Jersey and often overlooked on paystubs.

Optional and Employer-Specific Deductions

Beyond taxes, your paycheck may also include:

- Retirement contributions (401(k), 403(b))

- Health, dental, or vision insurance premiums

- Union dues or charitable withholdings

These reduce your taxable income, which can help lower your overall tax bill.

If you want to see how pre-tax deductions affect your take-home pay, use the gross-to-net paycheck calculator.

Example: A $60,000 Salary in New Jersey (2025)

Here’s a rough illustration for a single filer earning $60,000 annually:

| Deduction Type | Approx. Amount per Paycheck (Biweekly) | Notes |

|---|---|---|

| Federal Income Tax | $230 – $250 | Based on W-4 and tax bracket |

| Social Security (6.2%) | $143 | Mandatory FICA contribution |

| Medicare (1.45%) | $33 | Standard rate |

| NJ State Income Tax | $130 – $150 | Progressive system |

| NJ UI, DI, FLI | $15 – $20 | State insurance programs |

| Net Pay (Take-Home) | ≈ $1,950 | After taxes and deductions |

(Values are estimates; actual results vary based on benefits, location, and W-4 details.)

Common Questions About New Jersey Paycheck Taxes

Do New Jersey workers pay local city taxes?

No. New Jersey doesn’t have city-level income taxes like New York City or Philadelphia.

Why does my paycheck list UI, DI, or FLI deductions?

They’re state-mandated programs that protect workers during unemployment, disability, or family leave.

Are bonuses taxed differently?

Yes. Employers generally withhold a 22% federal flat rate on bonuses, plus state taxes.

How can I reduce my tax withholding?

You can adjust your W-4 form, increase 401(k) contributions, or review benefit selections to optimize take-home pay.

“Use our New Jersey Payroll Tax Calculator to see which state and federal taxes are deducted from your paycheck.”

“Learn about New Jersey FICA Taxes including Social Security and Medicare contributions.”

“Find out how New Jersey SDI Tax and Family Leave Insurance affect your take-home pay.”

“Understand What Payroll Taxes Employers Pay in New Jersey in addition to your employee deductions.”

“Estimate your total deductions using the New Jersey Paycheck Deductions Calculator.”

“Calculate your Gross-to-Net Pay to find your true take-home pay after all taxes.”

Juanita is the creator behind njpaycheckcalculator.org, dedicated to providing accurate and easy-to-use paycheck calculation tools for New Jersey residents. With a strong focus on clarity and reliability, she helps users understand their paychecks and tax deductions with confidence. Juanita is passionate about simplifying complex financial calculations, empowering users to make informed decisions about their income and budgeting.